Cryptocurrency, the digital revolution in finance, has redefined the way we store, send, and receive value. To navigate the world of cryptocurrencies, one needs a secure and reliable storage solution: the cryptocurrency wallet. In this blog, we will define cryptocurrency wallets, explore the differences between hot and cold wallets in terms of security, introduce common wallet types (software and hardware), and discuss the pivotal role of private keys in controlling access to cryptocurrency holdings.

Cryptocurrency Wallets: The Basics

A cryptocurrency wallet is a digital tool that allows users to manage their cryptocurrency assets. It serves a similar purpose to a traditional wallet for physical currency but is designed specifically for digital coins and tokens. These wallets enable users to store, send, and receive cryptocurrencies securely.

Difference Between Hot and Cold Wallets

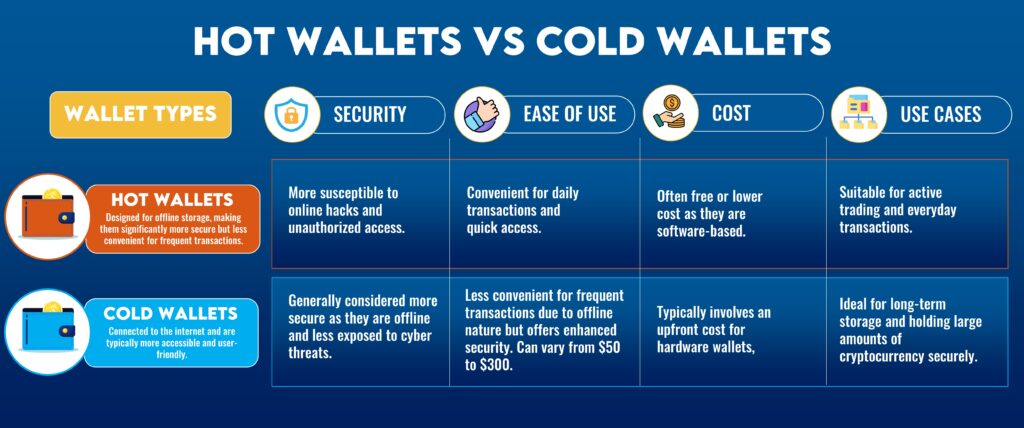

Cryptocurrency wallets can be categorized into two main types: hot wallets and cold wallets, each offering distinct advantages and security trade-offs.

Hot Wallets: These wallets are connected to the internet and are typically more accessible and user-friendly. They are often used for day-to-day transactions, making them convenient for individuals who need quick and easy access to their cryptocurrency holdings. Examples of hot wallets include desktop wallets, mobile wallets, and web wallets.

Cold Wallets: Cold wallets, on the other hand, are designed for offline storage, making them significantly more secure but less convenient for frequent transactions. The most common type of cold wallet is the hardware wallet, which is a physical device that stores the user’s private keys offline.

The key security trade-off is that hot wallets are more susceptible to online threats, such as hacking and phishing attacks, while cold wallets are immune to such risks but require more effort to access and use.

Types of Cryptocurrency Wallets

- Software Wallets:

- Desktop Wallets: These are applications that you can install on your computer. They offer good security and control, as your private keys are stored locally. Popular desktop wallets include Electrum (for Bitcoin) and Exodus (for various cryptocurrencies).

- Mobile Wallets: Mobile wallets are apps designed for smartphones and tablets. They provide the convenience of on-the-go access to your cryptocurrency holdings. Examples include Trust Wallet and MyEtherWallet.

- Web Wallets: These are online wallets that you can access through a web browser. While they are user-friendly and convenient, they are considered less secure, as the private keys are stored on a third-party server. The most popular web wallets is MetaMask .

- Hardware Wallets:

- Hardware wallets are physical devices that store your private keys offline, making them one of the most secure options available. Examples of popular hardware wallets include Ledger Nano S, Ledger Nano X, and Trezor. These wallets are immune to online threats, as they never expose your private keys to the internet.

Private Keys: The Key to Security

In the world of cryptocurrency, private keys are the digital keys to your financial kingdom. These are long strings of numbers and letters that serve as a cryptographic signature for your transactions. Owning the private key means having control over your cryptocurrency holdings, as it is the only way to authorize transactions from your wallet.

The security of your private keys is paramount. If someone gains access to your private key, they can access your cryptocurrency holdings and potentially steal your assets. This is why hardware wallets are highly recommended for those looking to maximize security, as they keep private keys offline and protected from potential online threats.

Additionally, it’s essential to keep backups of your private keys in a secure place. Losing access to your private keys can result in the permanent loss of your cryptocurrency holdings.

Conclusion

Cryptocurrency wallets are an integral part of the cryptocurrency ecosystem, allowing users to store, send, and receive digital assets securely. Understanding the differences between hot and cold wallets, as well as the various types of software and hardware wallets, is crucial for making informed choices about managing your cryptocurrency holdings. Above all, remember that private keys are the keys to your financial sovereignty – protect them at all costs and choose a wallet that aligns with your security and accessibility preferences.